Swing Trading Strategy

In this blog post we will introduce you to the swing trading itself, swing strategies and techniques without hyperbolizing potential returns.

Four Kinds of Market Inefficiencies

Producing trading ideas may be a process that is frustrating, particularly if there is not a structured framework for it.

How to Place Stop Loss Profit Target

In this post we’ll cover sell stop limits, sell stops, buy stop limits, buy stops, as well as techniques and tips on how to effectively place them in any kind of market.

Day Trading Strategies: Momentum Strategy

Many day traders use momentum strategies to take advantage of trends. In this post we create a simple momentum strategy without using

Learn Algorithmic Trading

Algorithmic trading is a concept that is employed most often in online trading today. The process for algorithmic trading involves having a set pattern with clearly defined trading instructions for a particular trading platform.

Quant Savvy Feedback

We welcome all Quant Savvy feedback. Be it from potential users or existing users. We are curious to hear from you anything related to algorithmic trading, topics can include: What other information you would like to see on the website Questions you feel we should address regarding our algorithmic trading systems Current trading experience Difficulty […]

Why You Need to Use Alternative Data

It is estimated that asset managers are currently spending $2-3 billion on alternative data, including acquiring datasets, implementing big data technology, and hiring talent. Spending is projected to grow 10-20% annually, in line with big data growth in other industries.

Finding a Daytrading Edge

What is day trading edge and how to find it? Here’s our formula

Quantifying market inefficiency or behaviour beyond randomness

Define the behaviour, determine the conditions the behaviour persists and then data mine and create code that best fits this non-random behaviour.

Profitable Day Trading Over X Timeframe

Profitable day trading: maximise profits and minimise drawdowns

Second Day Gap Day Trading Strategy

If you are having difficulty finding an edge or need a little guidance where to start then read the following post.

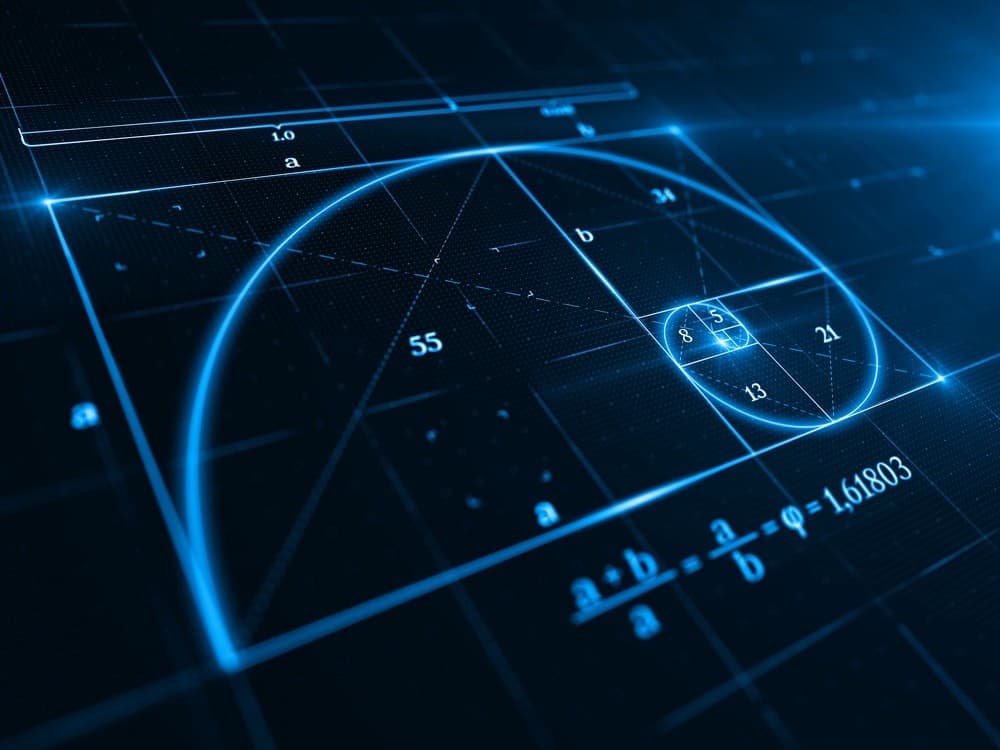

Fibonacci Daytrading

Nearly all day traders have heard of the Fibonacci extensions or fib time cycles. In this article, we will outline correct methods to use Fibonacci Extensions to find trend reversal price levels.

Autonomous Algorithmic Trading Platforms

Algorithmic trading has taken a huge front seat in the investment sector this week.