Do We Need Stops with Algo Systems?

Every day traders and system traders have always been told to use some type of stop.

Drawdown is Misleading Metric in Futures Trading

In my experience, drawdown can be one of the most misleading metrics when analysing system performance.

Finding a Daytrading Edge

What is day trading edge and how to find it? Here’s our formula

Quantifying market inefficiency or behaviour beyond randomness

Define the behaviour, determine the conditions the behaviour persists and then data mine and create code that best fits this non-random behaviour.

Profitable Day Trading Over X Timeframe

Profitable day trading: maximise profits and minimise drawdowns

Algorithmic Trading During Volatility Spike

How to manage trading risks during volatile period

Second Day Gap Day Trading Strategy

If you are having difficulty finding an edge or need a little guidance where to start then read the following post.

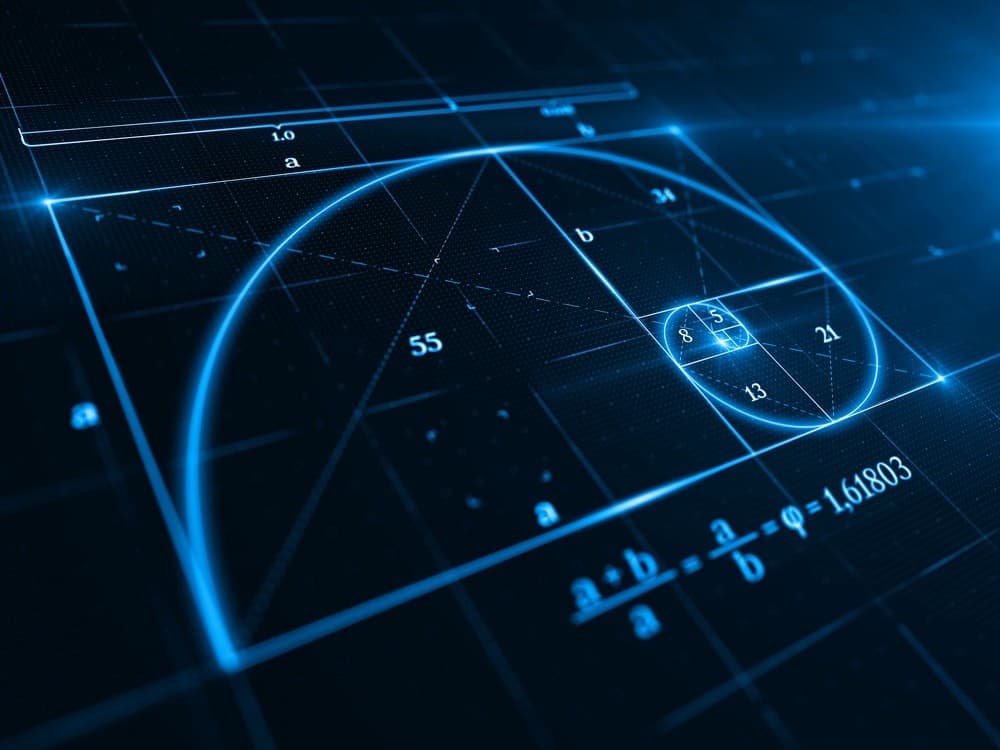

Fibonacci Daytrading

Nearly all day traders have heard of the Fibonacci extensions or fib time cycles. In this article, we will outline correct methods to use Fibonacci Extensions to find trend reversal price levels.

Here is why 2017 Was a Problematic Year for Quant Trading Systems

For more significant quant funds, with the positive attention they received over the last decade we find they attracted too much money too quickly and more people who use the same strategy will ultimately see a deterioration of its edge over time.

Do You Have To Buy Stocks While Investing For Retirement?

Doubts soar about the longevity of the bull market, that you may ask yourself: Should I skip stocks altogether while investing for retirement?

How to Maximize Returns while Trading the Market Volatility

How maximise your returns trading during market volatility? Here’s a few simple steps.

How to use the Interest Rate Parity to Trade Forex

The interest rate decision by Federal Reserve this year, has been the most critical discussions by financial professionals across the world.

Autonomous Algorithmic Trading Platforms

Algorithmic trading has taken a huge front seat in the investment sector this week.