Table of Contents

1. Introduction to Investment Psychology

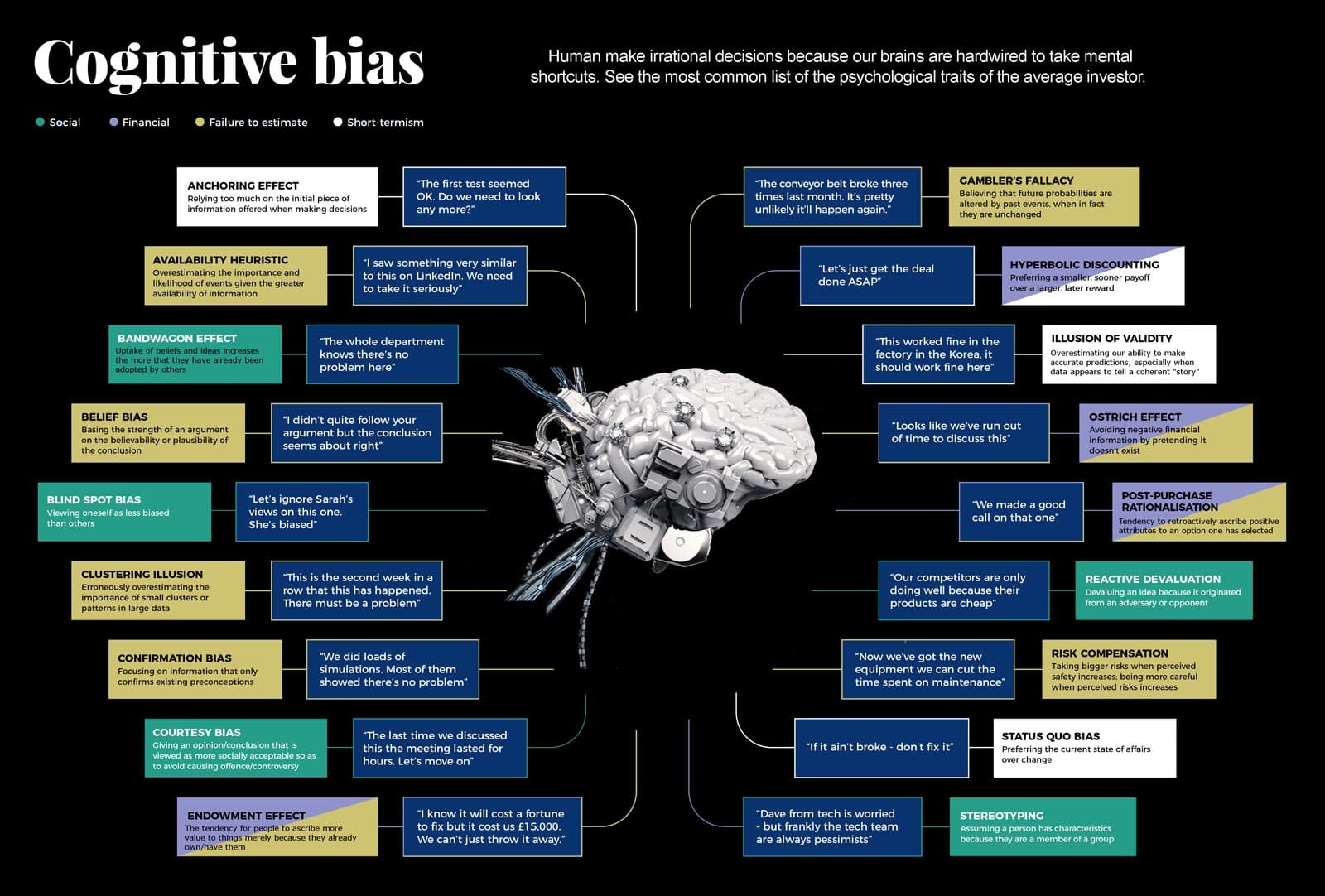

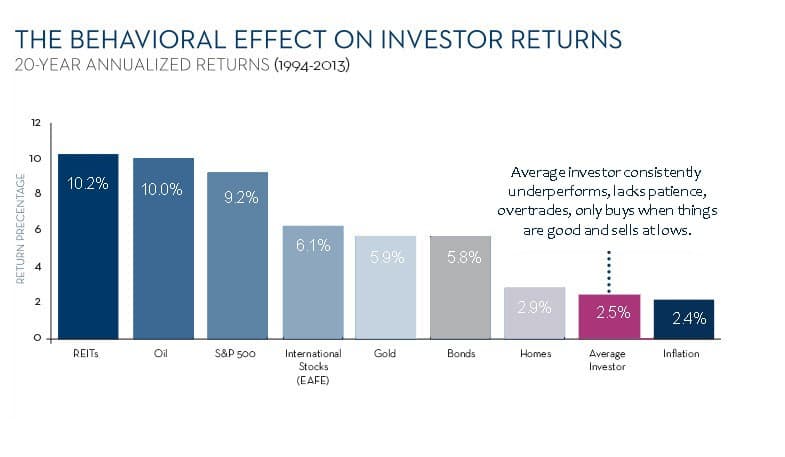

Behavioural Finance Theory Demonstrates Common Cognitive Biases That Make Humans Poor Traders

As global financial markets become more complex, professional traders turn to technology to assist in decision-making and manage investing psychology. Algorithms help traders make sense of the vast amount of information available, increase portfolio efficiency, and even substitute the human element entirely.

Today, algorithmic trading accounts for nearly 90 percent of the market. High-frequency trading tools buy and sell financial instruments in fractions of a second. AI-based models predict the best trade hours, days, weeks, or even months into the future.

The benefits of using algorithms in trading are numerous. Algorithms can automate investment portfolios, reducing fees, increasing efficiency, and streamlining the investment process through a computerized interface. They maintain a systematic process, offering investment returns more protection from ‘bad behavior’ than ever before.

Most importantly, algorithmic trading minimizes the need for human decision-makers. Human judgment can often lag behind reality, but algorithms correct errors and biases, helping us make better decisions based on data rather than habits, traditions, or superstitions.

Behavioural Biases and Why Investors Make Bad Decisions:

Nobel Laureate Economist Daniel Kahneman, in his paper ‘Maps of Bounded Rationality: A Perspective on Intuitive Judgment,’ demonstrated that people often fail to fully analyze situations and behave illogically when making complex judgments in uncertain situations. Applied to behavioral finance, his work points to human susceptibility to heuristic decision-making, cognitive biases, and emotions. Here are the ten most frequent biases investors fall into when making trading decisions.

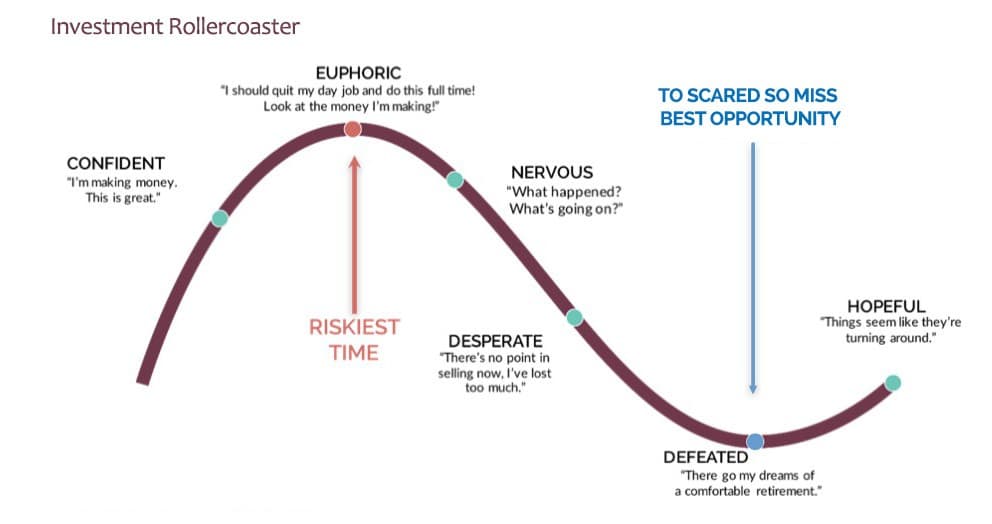

For many investors, the market’s deranged ups and downs feel like a ride driven by headless chickens. These erratic, sharp short-term movements create anxiety, often leading to harmful financial decisions.

Emotions remain dominant for the average investor. Instead of staying invested for the long run, they tend to buy high and sell low. Investors never want to miss a market surge (buying at all-time highs), but they often panic during bear markets and hit the eject button.

The image below represents the typical emotional investing cycle:

2. Overconfidence

Psychology finds that humans tend to have unwarranted confidence in their decision-making and an inflated view of their abilities. Overconfidence has two components: overrating the quality of our information and our ability to act on that information at the right time for maximum gain. Studies show that overconfident traders trade more frequently and fail to diversify their portfolios appropriately.

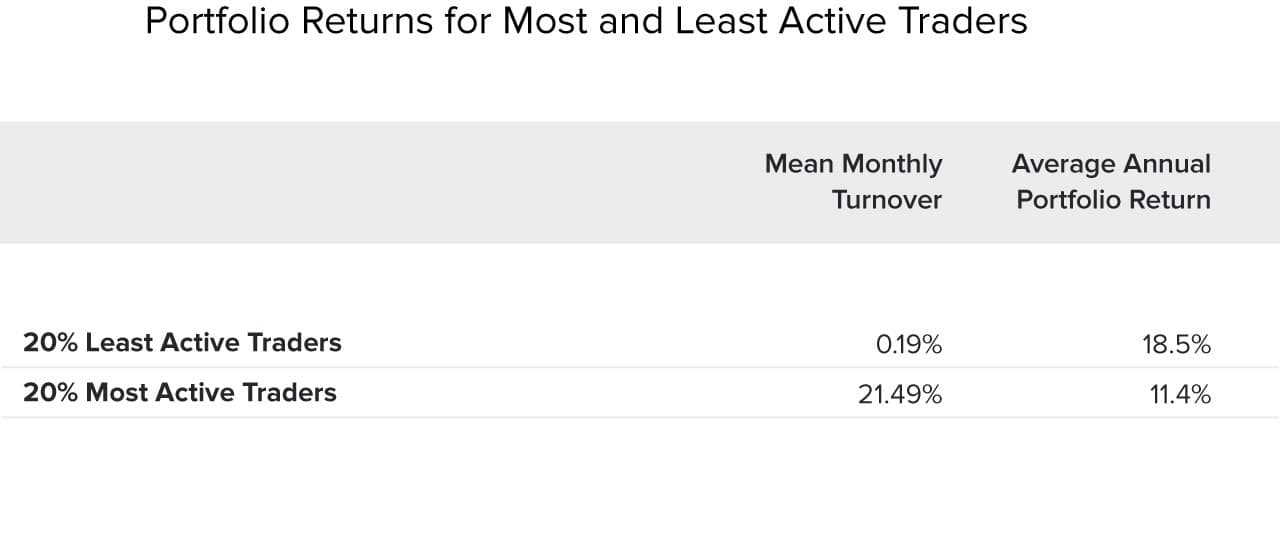

Overconfidence and Active Trading

Investors’ overconfidence can affect the volume of trading. Researchers have found that overconfident traders trade more often than rational traders. This excessive trading, commonly called “active trading,” can adversely affect overall returns. Many studies show that households that trade frequently generate annual returns up to seven percentage points lower than those that trade less frequently. Overconfident, overly active investors trade even when the expected returns are lower than their trading costs.

3. Anchoring and Adjustment

This theory holds that we place too much weight on the initial piece of information we discover – the “anchor.” Our bias is in interpreting subsequent information around that anchor. Investors tend to “over-anchor” initial assessments without reassessing the initial information and without giving new information sufficient attention. Decisions can also be ‘anchored’ by the way information is presented. In finance, values such as market index levels can act as anchors. Round numbers, like 5,000 points on the FTSE 100 Index, attract disproportionate interest despite being just numbers.

4. Frame Dependence

“Frame dependence” holds that investors’ risk tolerances change with the overall market direction. Investors are overly cautious in a falling market and too confident when things go well. This explains markets’ tendencies to overshoot and runs against true contrarianism.

5. Availability Bias

Availability bias concerns investors’ tendency to focus too much on frequently mentioned and readily available information without giving sufficient weight to other factors that may be less readily available or not deemed newsworthy or important.

Some evidence suggests that recently observed or experienced events strongly influence decisions. For example, investors are more likely to fear a stock market crash when one has occurred recently.

6. Representativeness

‘Representativeness bias’ reflects decisions made based on superficial characteristics rather than a detailed evaluation of reality. A typical financial example is investors assuming shares in a high-profile, well-managed company will automatically be a good investment. This idea sounds reasonable but ignores the possibility that the share price already reflects the company’s quality, thus future return prospects may be moderate.

7. Reducing Regret

Humans try to avoid the feeling of regret as much as possible. Often we will go to great lengths, sometimes illogical lengths, to avoid owning the feeling of regret. By not selling a position and locking in a loss, a trader avoids dealing with regret. Failing to act is also known as inertia. Uncertainty and confusion about proceeding lies at the heart of inertia. For example, if an investor is considering changing their portfolio but lacks certainty about the merits, they may choose the most convenient path – wait and see.

8. Limited Attention Span

Thousands of stocks are available, but individual investors have neither the time nor the desire to research each one. Humans are constrained by what economist and psychologist Herbert Simon called “bounded rationality.” This theory states that humans make decisions based on the limited knowledge they can accumulate. Instead of making the most efficient decision, they make the most satisfactory decision. Due to these limitations, investors tend to consider only stocks that come to their attention through websites, financial media, friends, family, or other sources outside their own research.

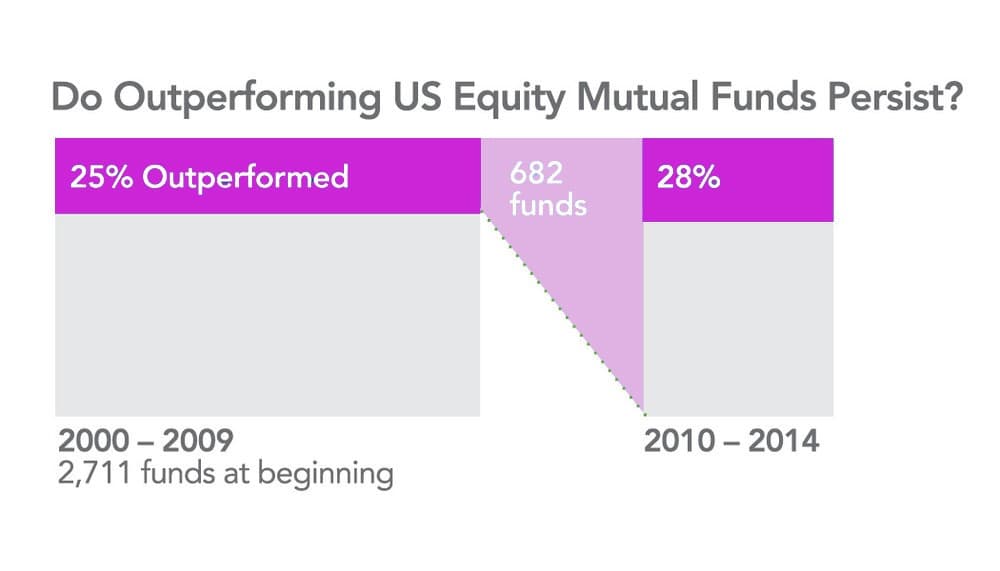

9. Chasing Trends

This is arguably the strongest trading bias. Humans have an extraordinary talent for detecting patterns and believing in their validity. When they find a pattern, they act on it, but often that pattern is already priced in. Even if a pattern is found, the market is far more random than most traders admit. The University of California study found that investors who based decisions on past performance often performed poorest compared to others.

10. Disposition Effect

When investors sell winning assets too soon and hold on to losing assets for too long, we call this anomaly the disposition effect. This is also known as the “sunk-cost fallacy” and is based on keeping a poor investment hoping it may recover. The disposition effect is reflected in aggregate stock trading volume. During a bull market, trading volume grows, and if the market nosedives, trading volume

falls.

11. Loss Aversion/Fear of Loss

Behavioural finance suggests investors are more sensitive to loss than risk and return. Some estimates suggest people weigh losses twice as heavily as potential gains. The idea of loss aversion also includes the tendency to avoid locking in a loss. The idea of a loss is so painful that people tend to delay recognizing it. More generally, investors with losing positions show a strong desire to get back to break even.

With so many flaws in our decision-making process and the explosion of available information, no wonder algorithmic trading brings great advantages to investors who use it.

12. Managing Investing Psychology

Advantages of Algorithmic Trading in Overcoming Behavioural Biases

Algorithmic trading eliminates human emotions that prevent investors from holding losses for a longer time and selling profitable securities too early. It also tests trade ideas on historical data to eliminate poor trading ideas and retain the good ones.

High-frequency traders, sometimes called flash traders, buy and sell thousands of shares every second, executing deals so quickly and on such a massive scale that they can win a fortune if the price of a stock fluctuates by even a few cents. Other algorithms are slower but more sophisticated, analyzing earning statements, stock performance, and news feeds to find attractive investments that others may have missed. The result is a system that is more efficient, faster, and smarter than any human.

Like most human traders, algorithms follow a simple set of rules. However, they respond instantly to ever-shifting market conditions, considering thousands or millions of data points every second. Each trade produces new data points, creating a conversation in which machines rapidly respond to each other’s actions. At its best, this system represents an efficient and intelligent capital allocation machine, a market ruled by precision and mathematics rather than emotion and fallible judgment.

Algorithmic trading is the response to a complex global financial system.

When trading thousands of stocks simultaneously, trying to capture minimal changes, it requires looking at hundreds of thousands of things simultaneously. It requires trading a little bit of each stock without falling into common mental traps. This can be overwhelming and too complex for the human brain. That is where algorithms come in handy.

Algorithms tend to see the market from a machine’s point of view rather than focus on individual stocks’ behavior. For instance, many prop-trading algorithms look at the market as a vast weather system, with trends and movements that can be predicted and capitalized upon. These patterns may not be visible to humans, but computers, with their ability to analyze massive amounts of data at lightning speed, can sense them.

A Look into the Future

In the future, we will witness high-level automation of the financial market, differing from what we see today. Algorithms will become more complex as algorithmic trading adjusts to different patterns using AI. Machine learning will shape algorithms that can pick techniques themselves. Moreover, they will handle real-time interpretation and integration of data from many sources while avoiding human decision-making flaws.

Large sums are currently being invested in automation intelligence and machine learning, including algo-trading platforms. As a market, algorithms are here to stay. Globally, there is increasing use of algorithms across European equity markets.

The future is bright, and exponential growth is expected for algorithmic trading systems. In the past two decades, only large banks and trading firms used algorithmic trading. Nowadays, retailers have also embraced algorithmic trading, witnessing significant growth. A huge rise in algorithmic trading is expected as more retailers learn the nuances and understand their advantages: the ability to process large amounts of information while overcoming the limited and often biased capacities of our brains. It’s time to think SMART – see Intraday Futures Trading Bot performance.