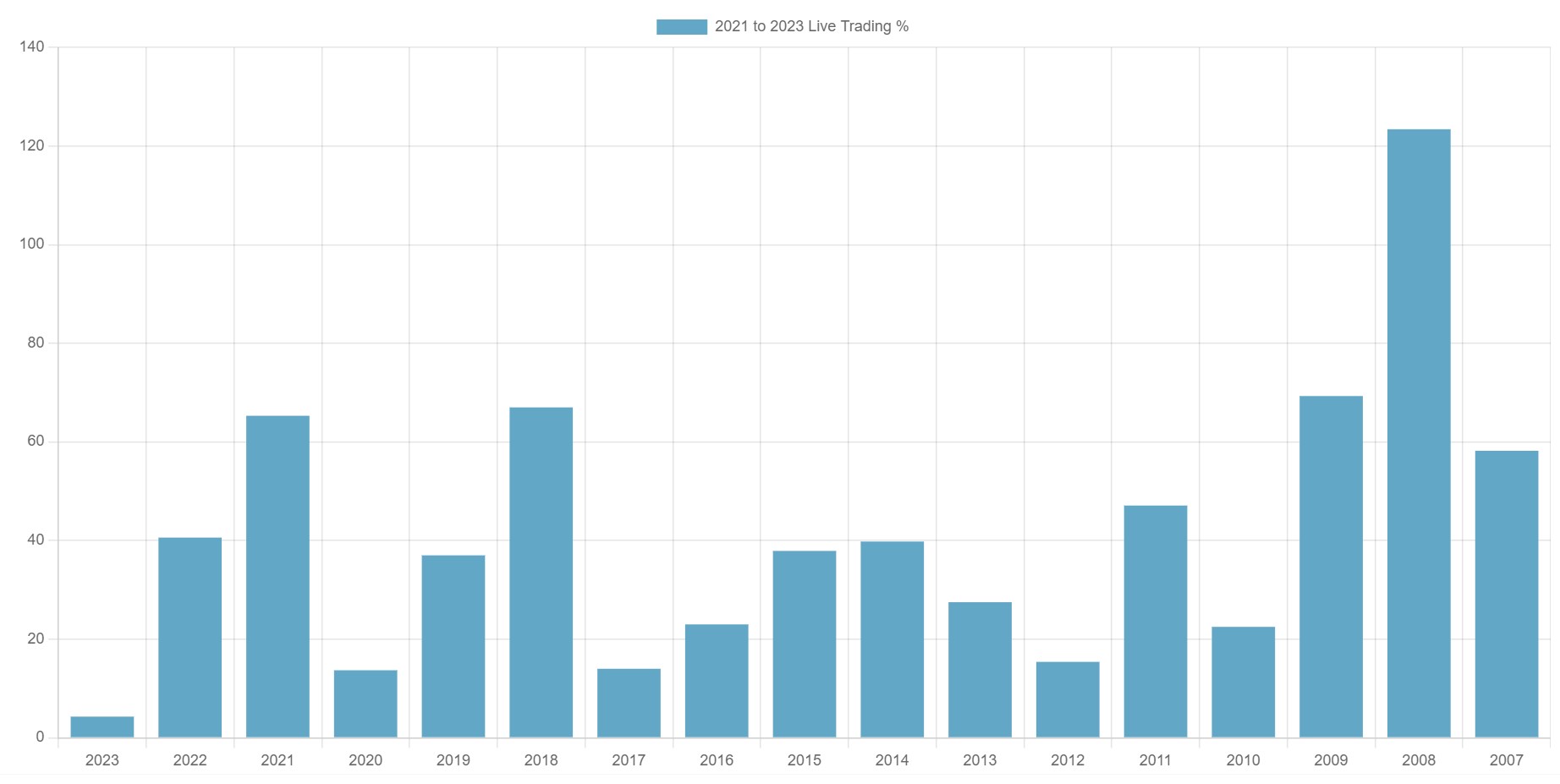

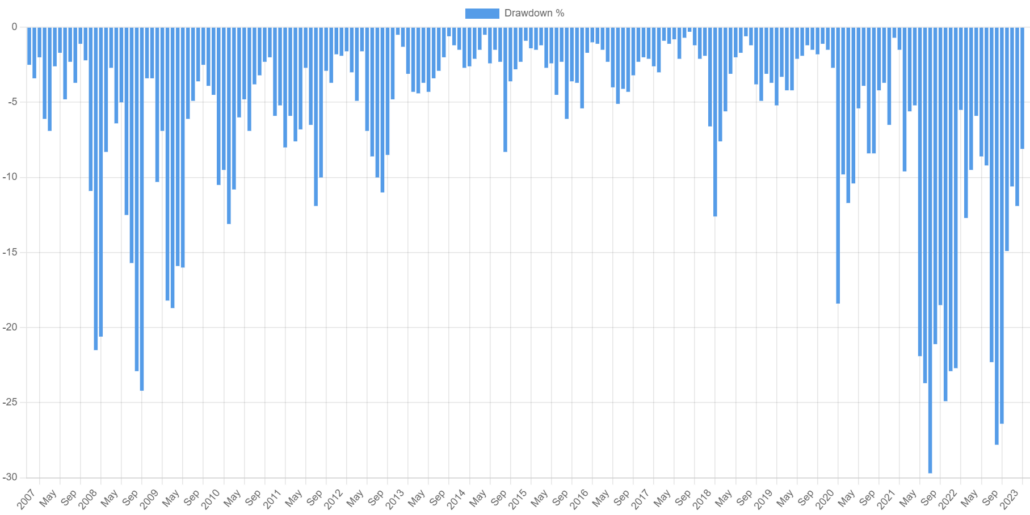

CFTC RULE 4.41 – Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under — or over — compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Statements posted from our actual customers trading the algorithms (algos) include slippage and commission. Statements posted are not fully audited or verified and should be considered as customer testimonials. Individual results do vary. They are real statements from real people trading our algorithms on auto-pilot and as far as we know, do NOT include any discretionary trades. Tradelists posted on this site also include slippage and commission. All advice and/or suggestions given in Quant Savvy website are intended for running automated software in simulation mode only. Trading futures is not for everyone and does carry a high level of risk. All past performance shown is backtested data only.