Table of Contents

Algorithmic Trading Software Reviews - Tradestation vs Multicharts vs NinjaTrader

One question many traders ask is, “What the best algorithmic trading software is to use?”. At Quant Savvy, we have tried nearly all principal brokers compatible with Multicharts, Ninjatrader and Tradestation, we are positioned perfectly to give you the best data and insight into real-live trading comparisons. Unlike other reviewers, we have traded live simultaneously multiple different broker and software combinations with identical strategies; we have comprehensive data on fill differences between platforms and brokers.

For automated trading backtesting, the right trading software must be selected based on your programming skill and expected probable hours learning a new language entirely to execute your algorithmic trading strategies correctly.

In this article, we will give a breakdown of software comparisons between NinjaTrader, Tradestation and Multicharts, which is intended to help you make the right choice for you and your algorithmic trading. However, even the best algorithmic trading software cannot guarantee good performance. Many traders get distracted with all charting capabilities and do not pay enough attention to developing a trading strategy that actually works. Interested in finding the best day trading platform? We’ve got you covered: read our ‘Best Day Trading Platform‘ blog article, where we’ve compared Interactive Brokers vs Tradestation vs AmiBroker vs eSignal vs NinjaTrader.

Similar Reviews: Interactive Brokers Review | TradeStation Review | NinjaTrader Review

1. Algorithmic Trading Software Reviews

Tradestation Review

This company has been around forever and earned many awards in the past. Recently they have made a substantial effort to rebrand and redesign to increase the user base. John Bartlemen was appointed President of Tradestation two years ago but has been with the company since 1999 under the guise of Omega Research.

The company now charges no data fees, no software fees to appeal to the broader audience. Tradestation is highly specialized software relative to other brokers; in the past, it appealed predominantly to the algorithmic trading crowd, but with the additions of Matrix, app trading and Trader Concierge program, it should widen the spectrum of potential clientele.

Tradestation has been cutting edge in some respects and even offers a great mobile trading application. The app has voice technology integration with Siri. Moreover, on-the-go traders can get alerted to earning reports as they are about to be released.

Multicharts Review

You can choose Multicharts (uses PowerLanguage) or Multicharts.net (uses C#). Multicharts is standalone automated trading backtest software and can connect to many different brokers; it has excellent charting and impressive live, automated trading abilities.

The purpose of Multicharts was to eliminate the weaknesses of all other comparative products to ensure an intuitive, streamlined experience that is custom fit to the user’s needs. Multicharts gives users the freedom to use numerous different brokers and has created built-in APIs for each compatible broker directly into the platform, making it very easy to trade.

Ninja Trader Review

Their robust platform has advanced features and technology to meet even the most demanding trader’s needs. This might be your ideal platform if you are a competent programmer with Java or C# skills.

NinjaTrader has been around since 2004 and has grown into a sizeable active trading firm with its brokerage facility; it now has over 40,000 users and counting.

It is an excellent testing platform for validating real market conditions with each backtest so that you can evaluate every trade correctly.

2. Stability and bugs:

Tradestation

- It can be left open for weeks at a time without any issues. Automated Trading systems have no problem working day after day.

- They have worked on platform stability considerably with recent updates, and this shows in the performance.

- Live data and historical data is accurate.

- We have heard from other traders that the workstation for Tradestation 9.5 has frozen many times with as little as four workspaces and a total of seven charts open.

- In our experience, the primary grievance is when an automated strategy encounters an error mid-trade and turns off – there is no alert for when this happens, which can be an issue, especially if you have a day job.

Multicharts

- This trading platform rarely crashes.

- It has built-in API’s for popular brokers, which tend to work very well, even though you sometimes must fiddle around with getting the data loaded.

- Software rarely crashes during live markets. However, with every new release, we do see some teething issues (they should try increasing the level of beta testing).

- There have been times when we get memory leaks, but the MC team is good at providing fixes very quickly.

Ninjatrader

- Although stability has improved with the latest versions, we still find in our experience, Ninja Trader is very buggy, and we have had many crashes or freezes.

- The latest improvements mean the platform is now multi-threaded makes for a better experience with NinjaTrader 8.

- The stability of the latest version is much better than the initial release.

- Some users have reported NinjaTrader 8 freezing while in a trade which then requires a restart. We have also experienced this issue a few times.

Winner: Tradestation

The difficult decision as all retail software has numerous issues with stability; however, with our live trading, we find that Tradestation has the most consistent performance and trading with real money is when stability really counts – learn more.

3. Programming Language:

Tradestation

- Uses Easylanguage, which, as implied, is very easy to use and implement trading strategies, even though it does have a 1000-page guide.

- Easylanguage is constrained in what it can achieve for more advanced algorithms and customisations. However, in our experience, there is little you can’t do especially with the ability to write DLL’s. Learning EasyLanguage does give you the ability to use it on Multicharts, which can easily be connected to many different brokers, including Interactive Brokers.

- You can write DLL’s so you can exploit the limitation of Easylanguage, but this is for the more advanced programmer. Read more about EasyLanguage Performance and limitations – click here.

- There is a decent guide on how to learn to code, and the learning curve is not very steep.

- TradeStation 9.5 workspaces are not compatible with TradeStation 10, which the majority of users find irritating.

Multicharts

- Multicharts PowerLanguage is almost identical to Tradestation Easy language. It can do most things but will be limited in some respects.

- PowerLanguage has a flat learning curve but allows you to automate complicated routines very easily.

- You do have the option of Multicharts.net, which is C# programming language and is .NET trading platform. You can combine the features of Multicharts with the endless possibilities of .NET.

- Using Multichart.NET allows you to create custom indicators and strategies just like NinjaTrader.

NinjaTrader

- For those with programming skills and already an understanding of C# this might be the best option.

- C# is a favourite programming language, and therefore you have tremendous support and plenty of resources to choose from online communities

- For very advanced, entirely customised trading systems, Easylanguage will have limitations, so NinjaTrader is a better choice.

- C# programming language might require some advanced programming skills, but NinjaTrader offers various tutorials to get started. However, some of the resources are outdated and have not been updated since 2017. There are also several third-party courses, starting from as little as £13.99.

Winner: NinjaTrader

The running joke is that Traders developed Easylanguage for traders, while programmers developed Ninja for programmers. However, we still find the ability to do absolutely anything for competent programmers gives NinjaTrader the edge.

4. Software Difficulty:

Tradestation

- The software is well-designed, and the user interface is simple. You can efficiently use the multitude of tools to create strategies, track positions, assess historical performance and trade live.

- The programming language is straightforward to get started with some simple strategies and build from there.

- There are plenty of learning resources provided by TradeStation and its community. Various apps, such as TradeStation University, are available. You can also find various learning resources on the TradeStation Market Insights and TradeStation Forum. YouCanTrade is one more education-focused website, running separately from TradeStation brokerage. This service provides access to full-featured courses, webinars, live trading rooms and more, starting from $99 monthly.

Multicharts

- The software comes with a 30-day free trial; it is relatively easy to download and install.

- There are 20 plus data feeds and brokers supported, and Multicharts has inbuilt APIs for most of them. Adding data and symbols to charts can be a little tricky and may require some practice.

- MultiCharts offer various resources to help their clients learn trading, including blog, video tutorials, online help & wiki, as well as a discussion forum.

- MultiCharts offers customization services, such as connecting data feeds or brokers that are currently not supported. MultiCharts team also offers its community to get involved in software development by requesting a feature via MultiCharts Project Manager.

NinjaTrader

- C# programming difficulty again comes down to your coding ability; those experienced will find the learning curve easier. However, with NinjaTrader 7, there was a lack of online guides and web material, which has been improved considerably with NinjaTrader 8.

- NinjaTrader takes longer to learn and requires a lot of knowledge-seeking from multiple sources. Ninja Trader itself provides free trading platform training webinars, education videos and media-rich Help Guide. However, NinjaTrader platform webinars are available only for registered users.

Winner: Multicharts

It will take time to learn any of these platforms; for us, we just found it easier with Mulithcharts.

5. Data

Tradestation

- Access historical data from the inception of Emini’s, e.g. ES market data from 1997 onwards, are available on request and will load very quickly.

- For Futures accounts, data is now free. You can load minute historical for stocks and futures for free. (added pricing table below)

- Some traders still think for quality data, we should avoid broker data and use a real-time data provider like CQG and DTN; however, in our experience, Tradestation data compares acceptably.

- HISTORICAL DATA: (Source)

- Stocks and Indexes- Tick-by-tick data is available for thirty days back, one-minute data for ten years back, and daily data for more than 30 years back.

- Futures- Tick-by-tick data for thirty days back, one-minute data since January 1982, pit data for individual contracts (delivery month/year) since 1970, and back-adjusted continuous contracts since the 1960s.

- Options- Data availability for options contracts is similar to that for futures but will vary based on how heavily the contract is traded.

- Futures and options contracts with expirations well into the future may have little or no data due to light trading. For example, as of November 15, 2001, the December 2001 E-Mini S&P 500 might average over 30,000 trades a day. However, a contract that expires further out in the future, such as the December 2003 E-Mini S&P 500 will most likely be far less actively traded.

- TradeStation future data costs: (Source)

Multicharts

- Multicharts does not come with any pre-built data feed, so you have the freedom of choice of using all popular data providers.

- You will need a data source; otherwise, there is little you can do.

- Can easily import and export data. In fact, you can export Tradestation data and import this directly into the Multicharts database without any issues.

- Operating Data Sources tool – a tool used to manage data sources

- Quote Manager – a tool used to manage database

- Read more about Multicharts data feed

- Free data available: immediately after installation, the only free data available is Free Quotes, free end-of-day historical daily data coming from Yahoo, Google and MSN (see Free Quotes).

NinjaTrader

- Kinetick data is free for end-of-day data for stocks, futures and forex, which is a big plus for those wanting to use this as a backtesting platform.

- Live data from Kinetick cost is extortionate at $60 fixed, and then futures exchanges like CME and CBOT are priced at $111 each per month!

- NinjaTrader does support additional market data providers such as Esignal, Tradestation, and IQ Feed – see the full list here. NinjaTrader itself offers to choose from three main data providers based on your specific trading needs: Continuum, Kinetick and Rithmic

- Continuum – data provider that delivers low-latency connectivity to the futures exchanges. It is highly recommended for traders who need fast and accurate data with seamless operation between analysis and trading execution. CQG data feeds deliver real-time and historical data from seventy-five global sources. See full pricing here. CQG Server-Side Trading Tools eliminate the impact of geographic latency to give traders optimal order execution – Although CQG data feed is widely used, users tend to complain about its reliability and speed during busy times:

“When I’m connected to CQG I get a lot of pausing and spurts of data and freezing.

When connected to Rithmic, none of that exists.” – source.

- Rithmic – provides traders with high throughput performance and low latency connectivity performance formerly seen only by professional institutions. Rithmic also provides the ability to directly connect to them and use the same router as their engine (source). Our customers and other users tend to prefer Rithmic data feed over CQG due to faster fills and quotes (source). Rithmic is capable of offering tick-to-trade in less than 250µs – that is a quarter of a millisecond. However, Rithmic provides only one day of tick data, while CQG offer a month of tick data.

- Kinetick – highly recommended by NinjaTrader for streaming real-time quotes and historical data service. Currently, it offers professional market data for $65 per month but the price has increased over the past few years. Kinetick only offers servers to connect to in the US, so it would add a significant delay in transferring data from Eurex to the US and back. The main difference between CQG data feed and Kinetick is that Kinetick provides market data only, while Continuum provides both order feed and market data.

Winner: Tradestation

Very easy choice as the access to long-term historical data for free is unprecedented and a game changer. Free data that goes back 20 years for futures is perfect for new traders or those looking to automate their strategy.

Quant Savvy vs Major Indexes %

Outperform Major Hedge Funds using Quant Savvy Systems

Our edge? We execute small, strategic trades that let us swiftly enter and exit the market, unlike big funds that struggle with billion-dollar positions.

Precision day trading—quick in, quick out, capitalizing on market shifts while others lag behind

Discover the Numbers That Hedge Funds Don’t Want You to See!

5. Data

Tradestation

- Access historical data from the inception of Emini’s, e.g. ES market data from 1997 onwards, are available on request and will load very quickly.

- For Futures accounts, data is now free. You can load minute historical for stocks and futures for free. (added pricing table below)

- Some traders still think for quality data, we should avoid broker data and use a real-time data provider like CQG and DTN; however, in our experience, Tradestation data compares acceptably.

- HISTORICAL DATA: (Source)

- Stocks and Indexes- Tick-by-tick data is available for thirty days back, one-minute data for ten years back, and daily data for more than 30 years back.

- Futures- Tick-by-tick data for thirty days back, one-minute data since January 1982, pit data for individual contracts (delivery month/year) since 1970, and back-adjusted continuous contracts since the 1960s.

- Options- Data availability for options contracts is similar to that for futures but will vary based on how heavily the contract is traded.

- Futures and options contracts with expirations well into the future may have little or no data due to light trading. For example, as of November 15, 2001, the December 2001 E-Mini S&P 500 might average over 30,000 trades a day. However, a contract that expires further out in the future, such as the December 2003 E-Mini S&P 500 will most likely be far less actively traded.

- TradeStation future data costs: (Source)

Multicharts

- Multicharts does not come with any pre-built data feed, so you have the freedom of choice of using all popular data providers.

- You will need a data source; otherwise, there is little you can do.

- Can easily import and export data. In fact, you can export Tradestation data and import this directly into the Multicharts database without any issues.

- Operating Data Sources tool – a tool used to manage data sources

- Quote Manager – a tool used to manage database

- Read more about Multicharts data feed

- Free data available: immediately after installation, the only free data available is Free Quotes, free end-of-day historical daily data coming from Yahoo, Google and MSN (see Free Quotes).

NinjaTrader

- Kinetick data is free for end-of-day data for stocks, futures and forex, which is a big plus for those wanting to use this as a backtesting platform.

- Live data from Kinetick cost is extortionate at $60 fixed, and then futures exchanges like CME and CBOT are priced at $111 each per month!

- NinjaTrader does support additional market data providers such as Esignal, Tradestation, and IQ Feed – see the full list here. NinjaTrader itself offers to choose from three main data providers based on your specific trading needs: Continuum, Kinetick and Rithmic

- Continuum – data provider that delivers low-latency connectivity to the futures exchanges. It is highly recommended for traders who need fast and accurate data with seamless operation between analysis and trading execution. CQG data feeds deliver real-time and historical data from seventy-five global sources. See full pricing here. CQG Server-Side Trading Tools eliminate the impact of geographic latency to give traders optimal order execution – Although CQG data feed is widely used, users tend to complain about its reliability and speed during busy times:

“When I’m connected to CQG I get a lot of pausing and spurts of data and freezing.

When connected to Rithmic, none of that exists.” – source.

- Rithmic – provides traders with high throughput performance and low latency connectivity performance formerly seen only by professional institutions. Rithmic also provides the ability to directly connect to them and use the same router as their engine (source). Our customers and other users tend to prefer Rithmic data feed over CQG due to faster fills and quotes (source). Rithmic is capable of offering tick-to-trade in less than 250µs – that is a quarter of a millisecond. However, Rithmic provides only one day of tick data, while CQG offer a month of tick data.

- Kinetick – highly recommended by NinjaTrader for streaming real-time quotes and historical data service. Currently, it offers professional market data for $65 per month but the price has increased over the past few years. Kinetick only offers servers to connect to in the US, so it would add a significant delay in transferring data from Eurex to the US and back. The main difference between CQG data feed and Kinetick is that Kinetick provides market data only, while Continuum provides both order feed and market data.

Winner: Tradestation

Very easy choice as the access to long-term historical data for free is unprecedented and a game changer. Free data that goes back 20 years for futures is perfect for new traders or those looking to automate their strategy.

6. Mobile Trading App

Tradestation mobile app

- Day trade on the go with a very efficient and stylish mobile application. It has a 4.2 Android review score and a 4.6 Apple Store Rating. However, the app is only available in English.

- TradeStation’s mobile app offers a full-day trading functionality, thanks to Matrix (ladder trading) and complex options trading support. Note: Matrix requires Level II market data, which is available for an additional $11 per month.

- It provides the option to use the same order types and order terms as the web trading platform.

- Alerts and notifications: TradeStation apps offer to set up price alerts and notifications – this feature is unavailable on the web trading platform

- Insert the link

- While mobile watch lists automatically sync with the Web Trading platform, they do not sync with the TradeStation desktop platform.

Multicharts mobile app

- No mobile app but as long as your broker offers an app, e.g. Interactive broker, then this is a non-issue unless you are automating your trades. We would prefer to see an app in the future so automated traders can keep an eye on their strategies.

NinjaTrader mobile app

- Very disappointed there is no Ninja Trader mobile app. Trading on the move is merely not an option. However, NinjaTrader brokerage users can access their accounts through the CQG mobile app.

Winner: Tradestation

You can quickly access quotes, hot lists, and order matrix. The design is good, and transitions from viewing your portfolio to sending orders are effortless due to the well-designed interface. It is possible to analyse, and trade option spreads with strike and expirations and volume for markets.

7. Speed, Backtesting and Charting

The last thing you want is to code a system on one platform and then code the same one on another and get different results. If this is the case, something has clearly gone wrong in the testing process or the way the software calculates order entry.

Tradestation and Multicharts use the same language, so they crossover seamlessly. In fact, with most strategies, you can copy and paste the code from one platform to the other, and it will work (it might require a couple of keyword modifications). With a well-coded strategy, we will get the same backtest results with Tradestation and Multicharts as well as Ninja Trader – this shows us that whatever we are doing makes sense.

Tradestation

- Charting on browser-based and desktop applications focuses on keeping things simple. We find the layout designs clean and practical. Web trading is well-designed, and chart trading functionality is superior to many other brokers.

- Running a strategy with lots of loops on timeframes over ten years can take a long time and has been known to freeze.

- We have had Tradestation 9.5 crash if we perform backtest optimisations using a lot of data.

- We find Multicharts is faster performing backtests; we have confirmed this by running the same strategy backtest on the same set of data, and we discovered Multicharts is faster by 20%.

- Tradestation offers Walk-forward analysis as well as Monte Carlo analysis to be able to evaluate your strategy using historical data distributions.

- It can be challenging to run a portfolio backtest as Portfolio Maestro is needlessly complicated – learn why.

Multicharts

- Backtesting comparisons show it is 20% faster in the backtesting department than Tradestation; we tend to backtest our strategies in Multicharts and then transfer the code to Tradestation to ensure we get the same results.

- Charting is some of the best in the industry; it allows for Multi-time frame analysis, fast response time, and complete interactivity with everything on the screen.

- Dynamic portfolio backtesting lets you test your strategies as a portfolio; this can be applied to 100s of markets simultaneously. Portfolio backtesting is an invaluable tool during technical analysis and strategy development.

- Connect with one or more broker accounts and trade directly from DOM window; you can easily attach profit targets and stops strategies from manual entry positions.

- Multicharts automatically create detailed performance reports so the user can evaluate the backtest performance efficiently.

- Genetic optimizer and walk forward optimizer is also available with Multicharts.

- Multicharts can display a chart based on time, volume or tick-based. Moreover, you can use Heikin-Ashi, Renko, Kagi, Point and Figure charts and even run strategies and indicators on them.

- It does have issues with reliability with backtests; often, they work very differently to live to trade. This is especially apparent when you use intrabar order generation, which gives you unreasonable fills.

- Many new customers will find testing issues in which the backtest is overperforming based on improper code.

NinjaTrader

- NinjaTrader Strategy Analyzer: a free tool that allows you to run historical analysis on your NinjaScript-based automated trading strategies. Forward Walking tests are available, as well as multi-objective optimisation so you can input values for more than one performance metric for a given test. Monte Carlo Simulations can also be run. However, the tool is limited as it does not include news stories or fundamental analysis.

- NinjaTrader Market Analyzer: a quote sheet enabling real-time market scanning of multiple instruments based on your custom criteria. Market Analyzer can be used to display indicator, market and trade data in a customizable manner. However, many traders and reviewers have concerns over the speed of backtesting and even further concerns regarding Market Analyzer, especially when running scans of over 100 symbols.

- The user interface relative to Multicharts and Tradestation is somewhat lacking. It can be slow-loading charts or adjusting timeframes.

- Multi-time frame strategies can be applied.

- More than 100 pre-built indicators and the option of many more if you include the third-party indicator add-ons.

- Indicators and tools are highly customisable, as it to be expected with a C# driven programming software.

- NinjaTrader 8 is faster than 7; this is true for the overall platform and performing a backtest.

- You can run Monte Carlo simulation as well as walk forward optimization.

- NinjaTrader simulation engine is not a simple algorithm that fills your order once the market trades at your order price. The engine uses a methodical approach to control trade fill probability by including a number of variables, including ask/bid volume, trade volume, time (to simulate order queue position), and random time delays for switching between order states.

Winner: Multicharts

A tough choice for each platform has its merits. The way Quant Savvy designs systems and how we apply chart settings, we find Multicharts works better for us, I am sure every trader will have a different experience which is very normal.

8. Order Types, Stop-Loss Abilities and Trade Management:

Tradestation

- In TradeStation, there are four basic order types (Market, Limit, Stop-Market, Stop-Limit) combined with an order action (Buy, Sell, Sell Short, Buy to Cover, etc.).

- Tradestation TradeManager: The app window displays trade and account activity. All orders are logged to the TradeManager window on a real-time basis. Orders are colour-coded so you can differentiate between different order statuses at a glance. Colours are updated in real-time as the status of your orders changes. You can quickly close positions, cancel orders from the TradeManager window, and view your order history.

- TradeManager Analysis: is used to evaluate the performance of trades completed (open and closed) from one or more TradeStation accounts during a specified date range. You can also filter the report to include/exclude symbols of your choosing. When you click Generate, selected data from your account is polled and a summary report is produced. Once generated, the TradeManager Analysis Report lets you view information such as total net profit, the total number of trades, the largest losing trade, and more.

Multicharts

- It can range from simple stops to complex strategies with multiple targets, break-even levels, etc. All are easy to set up and customisable to your needs.

- With strategy programming, you still only have Limit buy and sell orders, Market buy and sell orders, and Limit stop orders. No other order types are supported, which is a shame as Interactive Brokers has many order types, which would be very appreciated. If a broker doesn’t support any of these order types, it is emulated within the software and released to the broker utilizing other supported order types. To learn more about a particular order type emulation for a particular broker, click here.

- The software comes with Order, and Position Tracker window, which will comprehensively summarise orders, positions, and accounts across all brokers used for your trading.

- Multicharts does have issues with tracking profits; this is more difficult because a 3rd party broker is required, and Multicharts cannot track things like commissions etc. You can do a basic track of live profit and loss statement – we expect this to be upgraded with future releases.

NinjaTrader

- You can build systems with many types of orders, and easily incorporate stop-loss orders and target orders. The normal limit, market and OCO (one cancels other) orders are available as well as trailing stops – click here to see NinjaTrader Order Types and their differences.

- All stops and target orders can be sent out as soon as you enter a trade. Hence if you lose an internet connection or get disconnected, your orders will remain on the trade network limiting a potential disaster situation.

- NinjaTrader’s Super Dom feature for trade management allows superior customisability. As with nearly all trading software, you can have one-click entries and exits. NinjaTrader also can be used with the Advanced Trade Management module.

Winner: NinjaTrader

Great Dom, more expansive array of order types.

9. Market Replay and Other Analytical Tools

Tradestation

- No built-in market replay functionality.

- TradeStation Analytics – a platform used to analyze markets and develop your trading strategy. The platform does not require any brokerage account but gives access to many TradeStation analysis tools, including RadarScreen, Matrix, OptionStation Pro, Easy Language, Portfolio Maestro and TradeStation Scanner. You can read more about these tools in our best-day trading platform review.

Multicharts

- The market replay feature is available, and you can recreate real-time trading. Even tick-by-tick replay can be performed.

- Tick-by-tick, Minute by Minute or Day-by-Day playback options.

- Multicharts can also recalculate your chart indicators on each tick, keeping the user synchronised with the actual market situation.

- Multiple playback speeds.

- You can jump back and forth in ticks on intraday charts; this is beneficial when you want to skip activity in a slow market.

- Global replay mode allows you to playback a market in several places at once.

- MultiCharts offer a load of analysis tools. Including volume analysis, trading system analysis and many others – click here to read more about MultiCharts analysis tools.

NinjaTrader

- Very advanced market replay ability; you can rewind to any trading day and practice as if you were trading live. This tool allows a manual day trader to test any new ideas or assess their chart reading abilities.

- NinjaTrader Historical Data Servers have 90 days of Marker Replay.

- It is also possible to import historical data into the platform if it follows the correct format of Market Replay Data.

- More tools and features, such as customisable charts and strategy analysers, are available.

Winner: Multicharts

This is just based on our personal preference.

10. Setup, Updates and Support:

Tradestation

- Customer support: Talking with Quant Savvy systems users directly who use Tradestation, we often get the same response of very slow service, often call wait times of 1 hour. Brokerage support or technical support has always been negative for Tradestation. Many users complain about excessive wait times and a lack of customer support.

- TradeStation Forum: Even though extensive, the forum is outdated and very difficult to navigate and search for various topics. You cannot search the forum with simple Google searches, which makes it difficult for non-Tradestation clients to get answers on technical issues they might want to answer before they join.

- Additional Support: TradeStation provides access to TradeStation University and TradeStation Market Insights to support their clients.

- Getting Started: Customer feedback has highlighted that opening an account with TradeStation can be a slow process.

- Tradestation offers one-hour private learning sessions for $150.

- Countless online help guides and YouTube videos are available.

Multicharts

- Live Support: Quality live support; you can live chat and usually connect to an agent within 5 minutes.

- If there is an issue, an agent will connect to your platform via Teamviewer to collect and review the error data.

- Multicharts has strong forum support.

- For example, new brokers supported are added with every new release; the popular Forex broker Oanda has been added.

- The developers listen to their clients and tend to implement features which have been requested. Often a client will request something via a support forum, and Multicharts will list the expected implementation time this feature might be rolled out.

- Video tutorials are available for nearly all broker setup combinations.

- Getting Started: MultiCharts provides a free 30 days trial for regular MultiCharts or for MultiCharts.NET. The platform is fully functional within the trial period so that users can test all available tools. To trade with MultiCharts, it is necessary to set up a data feed and broker profile. If you are utilizing automated trading, algorithmic trading systems are loaded into MultiCharts automated software – learn more.

NinjaTrader

- Getting Started: Carefully engineered their platform so a user can enjoy the quick and easy setup. You can download the program and be up and running within 15 minutes.

- They have very long release cycles. They do have multiple smaller releases to provide support for bug fixing.

- NinjaTrader forum: Responsive forums, nearly 10x the activity on forums compared to Multicharts. Impressively, many customer questions are answered by NinjaTrader’s official representatives. Therefore, the majority of bugs spotted by users are sorted by the NinjaTrader team.

- Everything from webinars, help guides and training videos as well as a very popular forum.

- The technical support can also be excellent either via email or the support forum.

Winner: Multicharts

Faster updates and release cycles. More responsive to user requests for new features. Very helpful support.

11. Indicators

Tradestation

- TradeStation contains over 120 technical indicators

- Clients can also share and sell their indicators via TradeStation Trading App Store, many products are free, but others can range between $50 per month to $200 per month

- There is at this time, over 1000 products available on the TradeStation app store.

Multicharts

- Multicharts Basic comes with many indicators preloaded.

- Multicharts.NET has volume profiling or Market profile as a built-in feature – this is supported by the platform instead of 3rd party, which makes it viable for the long term.

- An indicator on another indicator can be computed and displayed on a chart without any programming, e.g. if you want to calculate an RSI on a simple moving average, you can display the results on a chart very quickly.

- Multicharts has over 280 pre-built indicators; you can also use 3rd party add-on studies.

NinjaTrader

- With NinjaTrader, you can customise their platform and technical indicators. Even though we find most indicators to be useless, Ninja still has much more than the rest – see full list here.

- Well, over 100 pre-built indicators and a massive library of optional third-party indicator add-ons exist.

- You can even contact a NinjasScript consultant to assist you with the code.

Winner: NinjaTrader

NinjaTrader – has vastly more 3rd party add-ons. NinjaTrader is coded in C#, so the active algorithmic trading community is enormous.

12. Broker Compatibility:

Tradestation

- TradeStation US: they support no other brokers, as Tradestation has been a solid futures and options broker for many years

- TradeStation Global: Compatible with Interactive Brokers account

Multicharts

- Compatible with nearly all significant brokers such as Interactive Brokers, Gain Capital, and Oanda – see the complete list here.

NinjaTrader

- Since NinjaTrader launched its brokerage services in July 2014, it limited the number of 3rd party brokers which can be used. They only offer NinjaTrader Brokerage, Interactive Brokers, FXCM, MB Trading, Ameritrade and Forex.com.

Winner: Multicharts

This is solely for compatibility with numerous popular brokers.

13. Software Cost, Commissions and Fees

Tradestation

- Software and data are free for most clients’ accounts.

- You can trade Forex, Futures, Equities and Options with Tradestation. With the most common pricing structure for options trades cost $0.60 per contract for TS Select and $0.50 per contract for TS Go – see TradeStation pricing info here.

Multicharts

- Multicharts Is not a broker, so all commissions will be applied by the compatible broker you use. The data provider also determines the data cost you select.

- Multicharts does offer a 30-day free demo which is very useful for prospective clients.

- The software costs $99 per month for a 3-month subscription. However, a lifetime subscription can be purchased for $1497.

- Multicharts.NET also has the same pricing structure.

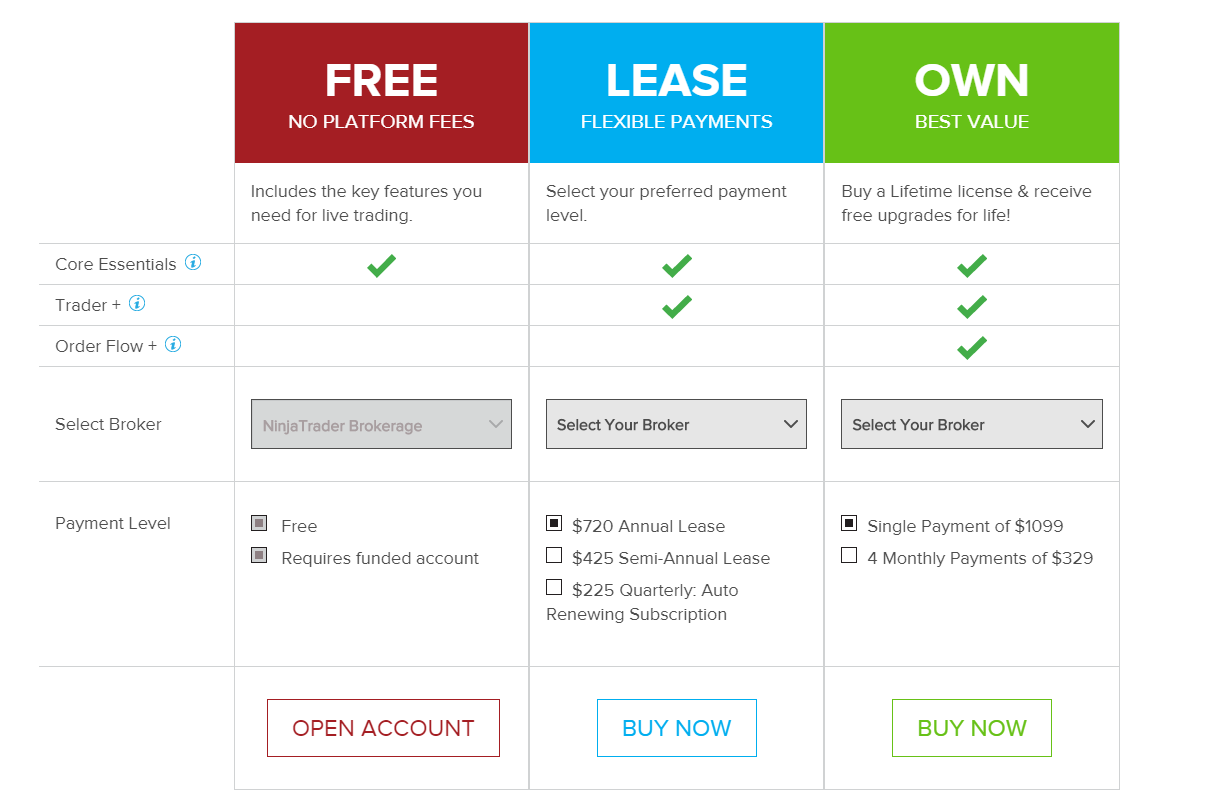

NinjaTrader

- Since NinjaTrader launched its brokerage services in July 2014, they limited the number of 3 rd party brokers which can be used. They only offer NinjaTrader Brokerage, Interactive Brokers, FXCM, MB Trading, Ameritrade and Forex.com.

- The minimum deposit for a futures trading account is $1,000, and $50 for a forex trading account. Day trading margins for popular futures such as the Emini S&P 500 are $500.

- Commissions typically start at $0.53 per contract, but this is dependent on whether you are leasing the software or using the free version.

- Purchase a Lifetime license for $1099 or an annual lease for $720 if you have a compatible broker.

- The free software version requires you to use NinjaTrader Brokerage.

Winner: Tradestation

Very low commissions, access to numerous markets, free software, and free historical one-minute data.

14. Live Performance:

At Quant Savvy, we trade our Intraday Futures Trading Bot live on both Tradestation and Multicharts. We use every major broker for live trading for our users. The same strategy is traded on different Servers located in the same area. This puts us in a unique position to compare the actual live performance (nearly all other forums and debates on this topic do not see daily live-fill comparisons for automated systems).

Tradestation

- Quant Savvy has calculated the fill difference between brokers when trading the same automated trading strategy, and we find Tradestation has the lowest latency and better fills. This can sometimes be as much as two tick better with standard Emini instruments.

Multicharts

- Interactive Brokers, AMP Futures, Dorman Trading, MB Trading, Futures Online, and Gain Capital, have all been traded live with Multicharts running the systems. We find Tradestation continually gets better fills than all broker combinations with Multicharts.

- The worst broker combination is anything that clears with Gain capital; not only do they have the worst live fills, but also, they can handle certain order types, except numerous rejected orders in high-speed markets.

Ninja Trader

- We do not compare Ninja Trader live fills, so we cannot comment, but our trading research has concluded that fills are decent.

Winner:

Tradestation has proven better fills and lower latency. If any reader wants to debate this point with us, we can show you the live trade-by-trade comparisons between the different trading strategy execution combinations. However, the results speak for themselves – our algorithmic trading systems loaded to TradeStation constantly get better fills compared to other trading software.

15. Conclusion:

You need to spend time on each platform and see which suits your trading style and personality. Traders who require more custom-built and complex systems might need to look at using C# or Python, but I would say for the other 95% of day traders Easylanguage will suffice.

Ninja Trader, although much improved, still has a steep learning curve for the average day trader who wants to start automating. There is no need to spend hours learning C# when nearly all systems and strategies can be coded with both Multicharts and Tradestation PowerLanguage/EasyLanguage. In our experience, some traders/programmers want to take the long route to the goal, often under the guise of technical superiority; trust us, most of the advanced coding is not required for the average algorithmic trading strategy.

Creating your own API’s or customising everything with NinjaTrader can be very wasteful, especially if you get bogged down with technical details instead of creating value.

All platforms have positives and negatives; for the Quant Savvy team, Tradestation is the winner. Tradestation has a highly rated mobile app, across-the-board commission price cuts combined with the free software and free live trading data and free historical data, which can go back 20 years, is a game changer. Tradestation has more than 30 years of experience; it has always been a leader and innovator in the automated trading realm.

Making money is the primary purpose for most traders (except the self-described elite programmers who like to write lovely complex, unnecessary code). The TradeStation live performance has better day trading fills, which means improved long-term results. Most other reviewers have never run all platforms simultaneously side by side to test live trading execution, whereas, as we offer the Quant Savvy algorithmic trading strategies to users who trade with numerous different brokers, we can easily track the live fills, Tradestation beats other fills 90% of the time. If you want to learn more about TradeStation, read our trading platform review, where we compared TradeStation vs Interactive Brokers vs Amibroker vs eSignal vs NinjaTrader.

We put a lot of effort into this post to help users seek the best algorithmic trading platform. We have over a decade of expertise in developing Quant Trading Systems; the current Intraday Futures Trading Bot we offer has been trading live since 2021 on TradeStation and Multicharts Interactive Brokers combination. Please look at the performance stats and get in touch with us if you are interested in making your money work for you fully automated.

16. Overall Winner: TradeStation

TradeStation is an overall winner for the algorithmic trading software and the best day trading platform. Our review has shown that TradeStation is the best day trading platform for beginners and intermediate traders using technical analysis or algorithmic trading. Tradestation TS is also a clear winner regarding the Mobile app, easy live Automated Trading, extensive free historical data, free 90-day tick data and a robust charting package.

Our clients use TradeStation daily, which has lived up to the hype. Quant Savvy has over a decade of experience creating automated trading systems; we have generated excellent live returns since 2021 and tested from 2007 onwards using TradeStation; if you decide to use TradeStation or Multicharts, then you can employ one of our winning strategies, click the link: to see the performance stats.

7 Responses

Really good article! I’ve been wanting to try out TradeStation for a while now.

What do you think about Sierra Chart? I have been using SC for a year now and I’m curious as if TradeStation is not gonna be a step down since I use very specific algorithms.

Thanks!

Hi Matt, we do not have a lot of experience with Sierra Chart, in the near future we will most likely review them and see if they compare with Tradestation especially in terms of live fills.

I have found that back testing in NinjaTrader is not possible for manual day trading. One second worth of ticks are combined together. You only see one ‘tick’ per second. This means the candles lurch around once per second, wrecking my ability to sense which direction the candle might be moving, It is in no way similar to live trading. I spoke with NT support who confirmed this limitation. They also confirmed importing tick data from a source like Kinetick (which is now a ridiculous $65 a month) results in the same poor historical playback behavior. This is really a bummer for me. I am still at the point where I am entering trades manually while attempting to code intelligent stops. My plan was to iron out my stops, then move on to coding my entries if possible. But I’m stuck in the mud on square one with NinjaTrader. So I am setting NinjaTrader aside and evaluating TradeStation and MultiCharts. We’ll see if they have the same limitations. I will try to report back here with what I learn. It’s possible they all suck at this. Not sure yet.

Similar to Interactive Brokers’ basic data feed which is aggregated for tick data and makes it useless for high-frequency strategies. If all ticks are combined into 1 second for Ninja Trader then that certainly makes it useless for any shorter-term intervals as a lot can happen in 1 second. If you do not want to pay for the excessive data fees with Kinetick then it might be easier just to use Tradestation where you can get free software and free data (which for Eminis goes all the way back to 1997 1min data and 90 days tick data).

I tried to get going with tradestation last April and they were unable to give me support for elementary issues in getting the software running let’s hope it was just due to the plague. by contrast multicharts gave me good help. unfortunately multicharts is now telling me I have to join a chat room to be able to update my crypto charts. it seems odd that it takes a village to raise a software

What is your thoughts on ProRealTime, especially in the algo and robot trading department? Tks

Thanks for a great article! Had all the information I needed to help me choose the right platform for me.